New York Solar Incentives and Solar Panel Tax Credits

There has never been a better time to go solar!

With flexible payment options and New York solar incentives, you’ll pay next to nothing for the total cost of solar panel system.

And you’ll save hundreds on your energy bill each month.

The Power of the Sun for as Little as $0 Down

Between 2008 and 2019, New York’s unstable power grid resulted in power outages affecting over 19 million inhabitants.

The state is now among the top ten in the U.S. transitioning to solar energy.

New York provides valuable solar incentives, including State Tax Credits, to make clean energy more affordable for homeowners.

New York offers solar incentives that make switching more affordable, including state tax credits and rebate programs. Homeowners can lock in lower energy costs while boosting their property value and supporting clean energy.

NY-Sun Megawatt Block Program

Homeowners in New York State will receive an instant rebate between .20 cents per watt and .50 cents per watt, depending on your location. This money comes directly off of the top of the system before any other incentives are applied.

Solar Energy System Equipment Tax Credit

Residents of New York are also offered a tax credit of up to $5000, for going solar in New York. This incentive can be claimed over a span of 5 years.

State Sales Tax Exemption

When you buy a new home solar energy system in New York, you won’t pay any sales taxes. The exemption is for 100% of the sales tax on an eligible solar installation. These New York solar panel incentives can save you upto 4%.

Choose A Plan That Works For You

Whether you choose to lease or purchase your solar system, our team will work hard

to ensure that you have the best looking solar panels and a energy system that

helps you save money for decades to come.

Monthly Lease

-

Only pay for the power you produce.

-

No Down Payment

-

Tax Incentives

-

Fixed Monthly Payment

-

25 Years to Pay Off

-

No Down Payment

-

25 Year Warranty

Finance to Own

-

Own Your System With No Upfront Costs and Flexible Loan Options.

-

No Down Payment

-

Owned by You

-

Tax Incentives

-

Fixed Monthly Payment

-

Loan Duration 10, 15, 20, 25 Years

-

Warranty: 25 Years

Purchase

-

No Monthly Payments Its Your System. You Own It.

-

Payment Due at Installation

-

Owned by You

-

No Monthly Payment

-

25 Year Warranty

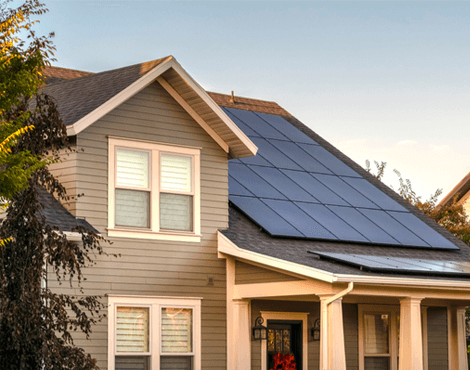

Our Work

We’ve help thousands of homeowners in your area switch to solar.

Join the Infinity family and start saving.

Calculate Your Savings

Use our solar calculator to see how much you can save by

switching to solar with Infinity Energy