New Jersey Solar Incentives and Solar Tax Credits

It’s never been a better time to go solar!

With flexible payment options and tax incentives, you’ll pay next to nothing for your solar system.

And you’ll save hundreds on your energy bill each month.

The Power of the Sun for as Little as $0 Down

The electricity rates in New Jersey are 33% higher compared to other states.

There are several New Jersey solar incentives to help you lease or purchase your solar panels and battery storage system.

New Jersey offers some of the strongest state incentives in the country.

New Jersey homeowners can save with strong state solar incentives, including credits for the clean energy your system produces. Going solar helps cut your electric bill, add value to your home, and lower your carbon footprint.

Renewable Energy Credits

RECs

REC programs are designed to reward New Jersey residents for switching to renewable energy. Here’s an example of how it works: for every 1,000 kWh of solar energy your system produces, you receive 1 REC to use toward shortening the time it takes to pay off the solar installation costs. On average our customers produce 10 recs per year and receive up to $90 per credit. That’s a total of $900 in savings.

Net Metering

With net metering, you receive complete credit for the electricity your panels provide to the grid. As a result, you’ll only be billed for the difference between your electricity consumption and the electricity your panels generate. Depending on your specific energy usage and production, this can result in a zero or even a negative electric bill.Going solar allows you to have a reduced electricity bill and increase the amount of money you save!

Property Tax Exemption

Sales Tax Exemption

Choose A Plan That Works For You

Whether you choose to lease or purchase your solar system, our team will work hard

to ensure that you have the best looking solar panels and a energy system that

helps you save money for decades to come.

Monthly Lease

-

Only pay for the power you produce.

-

No Down Payment

-

Owned by Lessor

-

Tax Incentives

-

Fixed Monthly Payment

-

25 Years to Pay Off

-

25 Year Warranty

Finance to Own

-

Own Your System With No Upfront Costs and Flexible Loan Options.

-

No Down Payment

-

Owned by You

-

Tax Incentives

-

Fixed Monthly Payment

-

Loan Duration 10, 15, 20, 25 Years

-

Warranty: 25 Years

Purchase

-

No Monthly Payments Its Your System. You Own It.

-

Payment Due at Installation

-

Owned by You

-

No Monthly Payment

-

25 Year Warranty

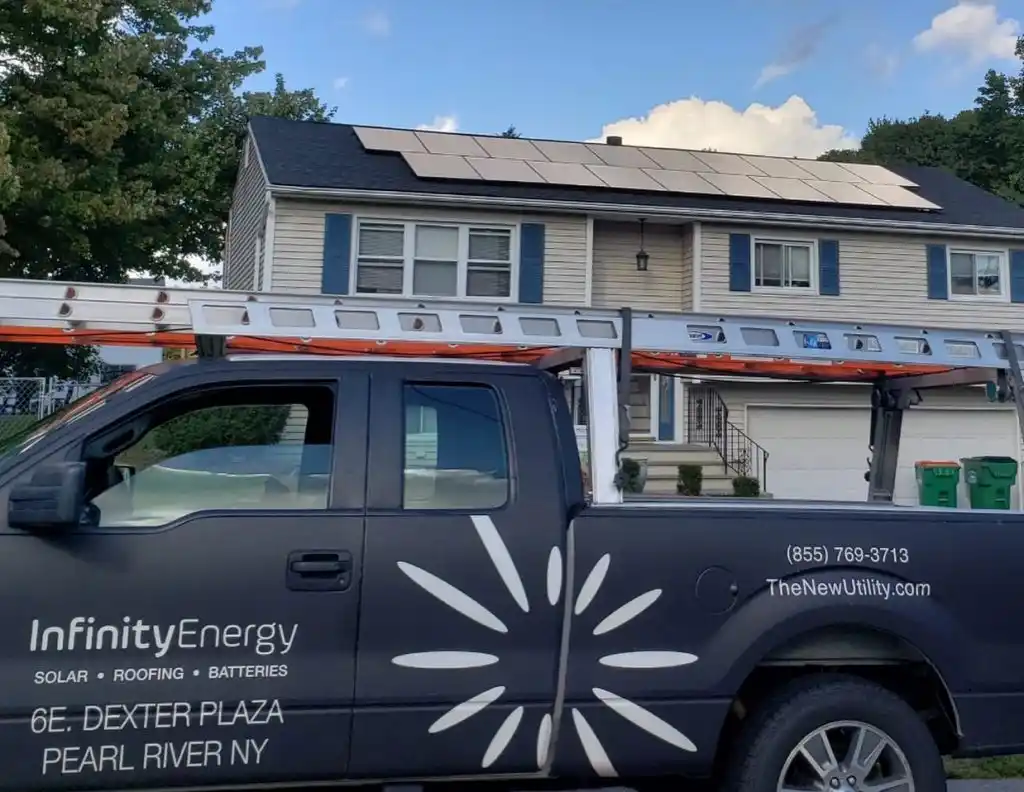

Our Work

We’ve help thousands of homeowners in your area switch to solar.

Join the Infinity family and start saving.

Calculate Your Savings

Use our solar calculator to see how much you can save by

switching to solar with Infinity Energy